Sewer User Rates

Fiscal Year 2023-2024

Fiscal Year 2023-2024 Stand Alone Prop 218 Rates.JPG

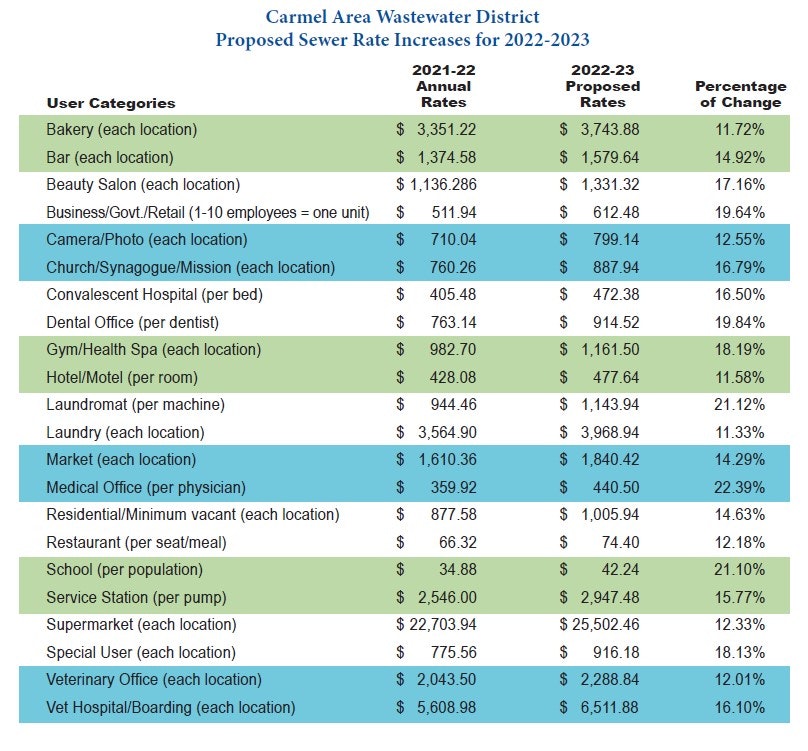

Fiscal year 2022-2023

Fiscal year 2021-2022

Proposition 218:

Notice of Public Hearing and Proposed Sewer Rate for Fiscal Year 2021-2022

Fiscal year 2020-2021

Proposition 218:

Notice of Public Hearing and Proposed Sewer Rates for Fiscal Year 2020-2021Fiscal year 2019-2020

Proposition 218:

Notice of Public Hearing and Proposed Sewer Rate for Fiscal Year 2019-2020CAWD does not send out wastewater bills to individual parcels in its service area. Instead we take advantage of Monterey County Property Tax Statements to convey CAWD charges to the property owner of record.

Please note however, that your sewer user fee is not a tax, rather it is an assessment attached to the property.

Refer to reference:

Proposition 218 Guide for Special Districts:

A special assessment, sometimes described as a local assessment, is a charge imposed on a specific real property for a local public improvement of direct benefit to that property, for example; a sewer connection, a street improvement, lighting improvement, irrigation improvement, , drainage improvement, or flood control improvement. The rationale of special assessment is that the assessed property has received a special benefit over and above that received by the general public. The general public should not be required to pay for special benefits for the few, and the few specially benefited should not be subsidized by the general public. (Solvang Mun. Improvement District. v. Board of Supervisors (1980) 112 Cal.App.3d 545.)

How to find information on Property Tax Statement:

Take a closer look at your Property Tax statement – approximately in the middle of the page is a section entitled “Voter Approved Taxes, Taxing Agency Direct Charges and Special Assessments”. You will find your sewer charge listed in this section along with any school bonds, ambulance charge, Regional Parks District charges, and any other charges that fit the required definition. We are listed as “Carmel Area Wastewater District” and as you can see, our charges are not based on assessed property value but rather are a Direct Charge reflecting the assessment necessary to recover the cost of providing service.

Should you have any questions about your sewer charge, or our rate setting process, please give us a call at 831-624-1248 or email downstream@cawd.org. CAWD is always happy to speak with our ratepayers.